Executive Summary

Multifamily operators face an interesting dilemma when the apartment communities they oversee have occupancies above target. They ask themselves, "What exactly should I do now when everything is working as it should be?" The truth is that full communities have opportunities to raise revenue and decrease expenses simultaneously. This resource will show you steps to take within your marketing, leasing, and pricing strategies at high-occupancy communities to do just that.

Read this resource if you're interested in:

- Making your marketing spend more efficient by focusing only on sources that create the most qualified leads for your leasing office.

- Developing a dynamic and predictive marketing budget so you can generate the right amount of web traffic to your community websites at the right time.

- Decreasing the average amount of vacant days that occur between residents.

- Marketing tools that enable you to pre-lease units when you don't have any available for in-person showings.

- Implementing smarter hold and lease renewal strategies that minimize vacancy and lost rent.

- Raising rents to increase revenue in a strong market.

Introduction: "What exactly is there to do when everything seems to be working as it should be?"

When there's an increase in vacancy at an apartment community, the responsibilities of the property manager, marketing director, leasing agents, and maintenance personnel suddenly become well-defined. Each team member is crucial in improving occupancy and understands the types of tasks necessary to accomplish them.

It explains why property management companies are still more attracted to underperforming communities in their portfolio because there will be obvious problems to fix. Teams feel the purpose of their work is most apparent when they're pouring more time and money towards resolving glaring vacancies at struggling properties.

Teams unintentionally ignore what's happening in high-occupancy communities because they feel less confident about what they should do daily when everything seemingly works.

The hidden truth is that there is more room for improvement at properties currently thriving than the ones that appear to be struggling on the surface. The opportunity available for communities with consistently higher occupancies can best be articulated with this question:

What if you could raise your revenue by 5%

while simultaneously decreasing your expenses by 1-2%?

In this resource, we'll explain how to manage apartment communities with high occupancy to maximize the potential for further revenue growth and decreased expenses while safeguarding your communities from letting complacency settle in. We will hone in on three non-mutually exclusive opportunities to choose from that help achieve this:

- Opportunity No. 1: Make Your Marketing Spend More Efficient

- Opportunity No. 2: Further Increase Occupancy By Decreasing The Number Of Vacant Days Between Residents

- Opportunity No. 3: Raise Your Rent Prices

We hope we provide you with a directive for how to proceed in your role when you're unsure what value you could bring to your already successful apartment communities.

Opportunity No. 1:

Make Your Marketing Spend More Efficient

Cut Underperforming Marketing Sources

Your marketing strategy, of course, is designed to generate demand and leads for your apartments. But if you can maintain a strong occupancy year-round, you don't have much need for excessive demand. Though most know this concept innately to be true, it needs to be more reflective in how many companies approach their marketing spend.

To elaborate, if you have a 100-unit apartment community at 98% occupancy heading into the winter—typically the slowest time of year in our industry—you would feel safe in that position. If, at that exact moment, 100 prospective residents are seeking to rent an apartment within your immediate marketplace, why would you continue to pay for all of your marketing sources and generate enough traffic and interest to fill 20 units when you only have two units available?

Simply being willing to cut an underperforming or unnecessary source, and therefore be able to funnel more money towards the channels that consistently deliver great leads instead, is a foundational and pivotal first step towards making your marketing spend more efficient.

This change enables you to shift towards a dynamic and predictive approach with your marketing strategy and budget (more on that later). When you've condensed your budgets towards allocating to only your most effective sources, you can confidently dial your spending up or down when necessary and still generate the amount of traffic you need precisely when you need it throughout the year.

Taking this step requires a thorough insight and analysis of each of your marketing sources so you can easily measure their individual performances. If you need help with how to start optimizing your marketing spend to make it more efficient, this is the first place to start.

Track Lead-To-Lease Conversions

A valuable method to measure the performance of your marketing sources is tracking their lead-to-lease conversion rates. Doing so involves implementing call and email tracking software that gives you the power to pinpoint from which source each lead to your apartment community originated.

With it, you can designate a unique phone number (or email address) for each marketing source. Though every single phone call or email from a marketing source would ultimately get redirected to your leasing office's number or the leasing agent assigned, this will give you the ability to go back and see how many prospective residents called the number or sent an email that's associated with one specific marketing source, such as your series of digital advertising campaigns in Google.

Once you can identify how many phone calls or emails each source generated to your leasing office, it becomes easier to see which sources are developing the most qualified leads and which ones aren't. When you can see how many of those qualified leads convert into leases, you can begin to prioritize the sources that led to the most conversions and safely cut funding to the ones that fail to produce a similar turnout. This way, you refrain from paying for sources that consistently generate unqualified demand that exceeds your supply.

Move On From Your Internet Listing Service Contract

Internet Listing Services (or ILS) like Apartments.com, Zillow, Rent, and others have long held their grip on the multifamily industry as many property management companies make these platforms an essential part of their marketing strategies. But when experiencing above-average occupancies, an ILS-centric marketing approach can become more expensive than it needs to be.

Now, ILSs are great channels for generating leads. However, in our years of experience operating as an apartment marketing company, we've observed most of those leads won’t be very qualified. We often find that many ILSs deliver far more email leads than phone calls, and email leads convert to leases at a meager rate. (If you have a method of tracking lead-to-lease conversion rates, you may come to the same conclusion once you start measuring other, more targeted sources, like your digital advertising campaigns, against your ILSs.)

Unless your ILS is your best source of leases, we'd be the first to tell you that it may be best to cut them out of your marketing strategy when occupancy is stable. Why?

1) ILSs lock into payment terms, costing you money even when your occupancy is strong.

Accepting an agreement with an ILS hinders your ability to make your marketing budget dynamic because you've locked yourself into a term payment structure that never changes regardless of your occupancy, which likely isn’t the best use of resources, knowing seasonality is ever-changing.

2) The ILS model makes driving more lease conversions unnecessarily harder and more expensive.

A significant hidden cost to utilizing an ILS is that your apartment community's listing is placed in direct comparison with competitor properties, and the only way to achieve higher visibility (or 'stand out' above others) is to increase your package and pay a higher monthly premium. So, unless you're paying for an ILS's top-tier package, your apartment community will begin to blur in with all the others, and chances are slim you'll see a desirable amount of generated leads that ultimately sign a lease from it.

3) ILSs steal traffic away from other paid marketing sources, forcing you to compete against yourself.

The other significant hidden cost is that ILSs purchase ads for the keywords related to your apartment community's name. When a prospective resident searches for you online in Google, the link to an ILS site might end up being featured above the link to your own community’s website. If you're utilizing other paid marketing sources like Google Ads, you're essentially paying for another marketing platform to compete against your marketing strategy.

Again, if you're convinced that your data proves an ILS is a reason your occupancy rates are high, then by all means, use them! But if they're not, you could save a lot of money in your marketing budget when your occupancy rates are high by eliminating ILSs from your plan.

Use Cost Per Minute Metric To Evaluate Digital Advertising Performance

If your apartment community deploys digital ads, whether in search engines like Google or social media platforms like Facebook, you may already be aware of the various metrics at your disposal to measure those ads' effectiveness.

The most popular metrics relied on by digital marketers include Cost-Per-Click, Bounce Rate, Conversions, and Keyword Relevancy. While each offers outstanding insight, the question we and others have debated for years is which of these metrics is the most valuable to evaluate.

A metric we recommend focusing on is Cost Per Minute because it gives one actionable number to help you determine the overall success of an ad campaign.

You can calculate Cost Per Minute by dividing the Cost-Per-Click with the Average Time On Site from a specific ad campaign. In other words, if an ad campaign drives visitors to your apartment community's website and they spend an average of 2 minutes and 30 seconds on the site, and if each click costs you $1.00, your Cost Per Minute for that campaign is $0.40 cents.

Cost-Per-Click / Avg. Time On Site = Cost Per Minute

$1.00 / 2.5 = $0.40/Minute

The lower your Cost Per Minute, the more effective your ad campaign is. It indicates that not only are your digital ads prompting more users to click on them, but that those users are spending significantly longer time engaging with the content on your website. We know that the longer a prospect stays on your website and views photos or videos of your units, the more likely they are to become a legitimate lead.

The beauty of Cost Per Minute is that it corroborates what those other, more traditional digital ad metrics suggest. For example, an ad set earning a low Cost-Per-Click would also result in a low Cost Per Minute. Or if your ads have a high bounce rate, meaning that visitors who come to your website leave it quickly, that would result in a high Cost Per Minute. We did a study on our websites some years back and found that visitors who converted into a lead spend 3-5 times as much time on the website as an average visitor, so this number, in due time, drives your conversions, too.

This one easily decipherable metric gives you an objective measurement of each of your various digital ad campaigns. Using it can help you as you work to make your marketing spend more efficient and cost-effective, as you'll be portioning more money towards ad campaigns that achieve the lowest Cost Per Minute.

Develop A Dynamic And Predictive Marketing Budget That Controls Vacancy

When occupancy has remained consistently stable, the door is open for apartment communities to begin to dial back advertising spend and save money. This is a quintessential practice of a dynamic apartment marketer, and a philosophy we believe every property management company should adopt because it maximizes your revenue.

But the unfortunate truth is that many multifamily operators continue to purchase and deploy static marketing tools, like the ILSs we discussed above, despite this opportunity.

It ties back loosely to an issue mentioned earlier: many within our industry are too afraid to change their marketing strategy because they believe their current strong occupancy results from how they've always done things. And why fix what isn’t broken?

Here’s why: when the weather changes in the fall, you turn on your furnace, right? Now imagine having your heat running on high. For an entire year. Despite the temperatures outside. That sounds pretty miserable, right? Especially if you live somewhere with a warm summer, which is most of us!

Locking yourself into terms with an ILS for a year and paying the same amount each month, regardless of your occupancy, is no different than leaving your furnace year-round. The same concept applies to spending on marketing sources. Most in the multifamily industry know that demand fluctuates at various times throughout the year, even at well-performing properties, but their marketing strategy continually doesn't account for those changes.

The first step in developing a dynamic and predictive marketing budget is identifying exactly when those changes will occur so that you can adjust your approach accordingly and appropriately for the upcoming season.

The next step is using that data to take control of your community's future vacancy.

To do this, you need to be able to:

- Predict when vacancy will occur.

- Know if that vacancy is going to be a problem.

- Be prepared to fix it.

With RentVision's Predictive Apartment Marketing solutions, all three are possible.

For readers who aren't aware of our solutions, we'd like to take this brief opportunity to explain how predictive apartment marketing works and why it's beneficial to every apartment community—especially ones with higher occupancies looking to save money and maximize revenue. We recommend that you schedule a demo for a more thorough explanation.

Our predictive algorithms are built around two key metrics we've created to help control future vacancy: Future Occupancy and Future Occupancy Target.

The Future Occupancy metric identifies exactly what your future occupancy and vacancy will be in the coming weeks based on when move-outs will occur and knowing which vacant or soon-to-be vacant units are already leased. This allows you to know what demand you'll need now to assist in marketing decisions.

To know whether your future vacancy will be a problem, we measure it against your Future Occupancy Target. Your Future Occupancy Target relies primarily on your apartment community's seasonality data to identify your future demand.

When your Future Occupancy is forecasted to be above your Future Occupancy Target, our predictive AI automatically dials back your marketing spend and saves money because occupancy is stable and you're not in a period with as much demand.

Inversely, when your Future Occupancy is below your Future Occupancy Target, the system gets in front of the potential vacancy problem by increasing ad spending to generate more demand.

These predictive apartment marketing metrics also enable property management teams to diagnose and correct the root causes of vacancy and prevent future vacancy crises from escalating further.

Implementing these tools in place now, while occupancy is strong, will positively impact you when things inevitably take a turn. Imagine how confident you would feel in your apartments' ability to withstand constant changes in demand?

Option No. 2: Further Increase Occupancy By Decreasing The Number Of Vacant Days Between Residents

Break Vacant Days Between Residents Into Two Time Periods

One sign of complacency settling into an apartment community's operation is if the average number of days between residents remains high. Despite what current performance indicates, the community's bottom line revenue is hit with unnecessary vacancy loss.

When the market is strong and high occupancy is easily achievable, apartment teams should take advantage of the opportunity to optimize their marketing and leasing to reduce the number of vacant days between residents moving out and moving in, thus further increasing occupancy and revenue. Doing so instills positive habits that will protect apartment communities during changes in demand down the road.

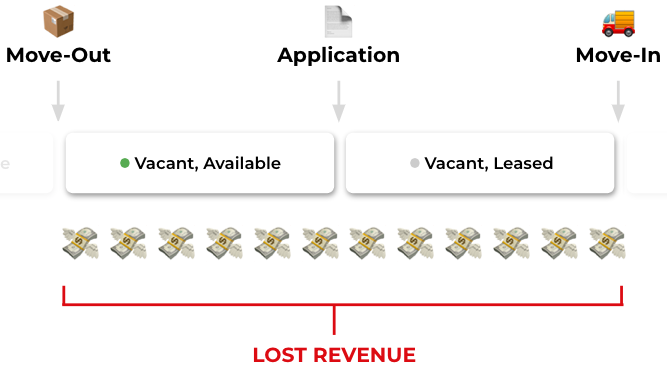

To start, we'd recommend breaking vacant days between residents into two separate periods to understand the specific changes your community can make to each period to lower the vacant days overall.

The first period is the number of days that occur between the unit going vacant and a rental application being received for it. The second is the number of days that occur after an application is received all the way up to the new resident's move-in day.

The latter timeline is only affected by how long you hold vacant, leased units. Later in this chapter, we'll explain how to adopt a dynamic hold policy to decrease this period.

In a strong market, in that first period—the number of days between when a unit goes vacant and an application is received—most apartment communities usually see their highest vacancy occur. But many ignore it because they're happy whenever a unit gets rented. The truth is, the duties of an apartment marketer are designated solely for shortening this duration no matter what the current state of the market is (this is crucial to increasing revenue).

In the following section, we'll offer one recommendation to help accomplish that.

Invest In Better Marketing That Enables You To Pre-Lease Units

The role of an apartment marketer seems clear when there's a vacancy problem. All of their focus is put towards delivering more leads to the leasing office by generating as much traffic as possible to their community's website.

But many in that seat may feel confused when occupancy is stable because it's not as clear what they should be doing on a day-to-day basis to further impact their apartment community because traffic generation isn't as necessary then.

That's why they should turn their focus towards shortening that first timeline, the days between a unit first going vacant and an application received for it, and the best course of action to do so—especially when occupancy is strong—is by investing in better marketing that enables you to pre-lease more units. After all, when your occupancy is strong, you may not have units available for in-person showings, so you will need an alternative option to let prospective residents see a unit they're interested in. That can be possible with better marketing that makes it easy for them to rent your apartments.

How do you do this? In interacting with many apartment communities, we've discovered that most have flawed community websites. The main issues we see are:

- Virtual touring options that could be more effective or included.

- Unorganized media content.

- Lack of current availability information.

- A neglected mobile presence.

Walkthrough Video Tours

How do you actually lease occupied units? It would be best if you gave confidence to prospective residents that the unit they will be renting looks nice and fits their unique needs. Walkthrough Video Tours do this very thing. They allow you to give a perfect showing of your floorplans—regardless of vacancy status—to thousands of people 24/7/365.

Walkthrough video tours have become an expectation for apartment shoppers. They want the ability to see the inside of units, and doing so from the comfort of their couch is a convenience that weighs favorably for your apartments during their decision-making process and helps you when you're unable to show a particular unit, too.

Without walkthrough video tours, an apartment community's website will fail to engage with prospects and could lose out on many leads. Investing in having an apartment marketing vendor professionally produce walkthrough video tours and make them a prominent feature for the end user would dramatically improve your marketing presence and leasing performance.

This isn't just a bold claim, either. Earlier in 2021, we did an internal study to measure the engagement of the walkthrough video tours we've produced and featured on our clients' community websites. The data confirmed walkthrough video tours both gain and keep attention.

Pages with walkthrough video tours had 2.5x as many views as pages without them.

We compared the traffic on floorplan pages with video tours and floorplan pages without video. During a 30-day period, pages with walkthrough videos had an average of 345 visits. Pages without a walkthrough video tour had an average of 134 visits during that same timeframe.

Walkthrough video tours keep a prospect’s attention longer.

Pages with walkthrough videos gain more views and keep prospects engaged for a more extended period. The average length of a RentVision walkthrough video tour is 2 minutes, 25 seconds. The average time on page for pages with walkthrough videos was 2:22—meaning the average time on page equaled 98% of the average video length. Floorplan pages without walkthrough videos had an average time on page of 1:15.

Prospects are watching walkthrough video tours, which is vital because that level of engagement works towards converting them from website visitors to qualified leads. They're also valuable for your leasing staff because they'll be able to work with an increasing number of prospective residents that are more likely to close due to having already seen their desired unit before even visiting your apartments in person. More importantly, this will prevent you from losing out on a great qualified lead during times of strong occupancy because you're able to pre-lease units that are currently occupied with the power of a walkthrough video tour.

Floorplan-Specific Content

Apartment marketers are intuitively aware of the importance of having beautiful media content featured on their websites. The issue, however, is that many apartment websites don't organize their media content and other relevant information in a clear or helpful fashion.

For example, on one page of a website you’ll often see a bunch of two-dimensional diagrams of floorplans. You might see rental prices and, if you're lucky, some availability. You won’t see floorplan-specific photos or video presented. Instead, a common website feature we come across on community websites is a separate page titled “gallery”, or something similar, where photos of the various units and amenities are all clumped together. While their intent is to attract and delight prospective residents with beautiful photos of the property, these gallery pages actually create more confusion. This will lead prospective residents to wonder, which photos represent what exact floorplan? And how will they know which photos match a unit that they are actually interested in leasing?

If you're a homeowner, you may understand why this is. Imagine if you were looking to buy a house, and the real estate agent only has photos of the exterior, as well as photos of the nearby community pool, dog park, and maybe one of the patio and firepit in the backyard.

This would be frustrating because, ultimately, you're most interested in the inside of the home. In the same way with gallery pages on apartment websites, prospects have no way of discerning if the kitchen photo is of the one in the floorplan they're interested in, or if it's the kitchen in a different floorplan.

This is why floorplan-specific content is a far better, more effective option because they give prospective residents an accurate assessment of the apartments, helping them gather all the information they need to feel confident in their decision to move forward with a lease.

We build our websites in this way so that prospects can go to a dedicated page of an individual floorplan and see photos and walkthrough video tours of that specific floorplan, as well as specified amenity, pricing, availability, a floorplan diagram, and other relevant information all in one place.

Mobile Website

It's critical that an apartment community's website is optimized for mobile devices. Apartment shoppers have turned to using them during their searches and our own data confirms this: 70% of all traffic to our clients' community websites originate from mobile users.

This means that websites should actually be designed with a mobile-first mentality as that is where a majority of prospective residents will engage with an apartment community. The experience of a desktop site should translate seamlessly to mobile, and still be easy for users to gather all the information they need on their phone to rent an apartment.

Evaluate Your Leasing Staff

The next stage towards working to shorten the days of vacancy is evaluating the leasing staff. You always have a need for reliable leasing agents who competently guide prospects through their own unique leasing journeys, and are able to close a consistently high amount of deals.

Perhaps when occupancy is stable is the best time to perform an evaluation because there's more opportunity to work closely with leasing agents to assess their work and offer guidance where needed.

Two key metrics by which we'd recommend evaluating leasing agents and their performance, if available, are average call duration and lead-to-lease conversion rate.

Studying a leasing agent's average call duration can help you learn a lot about their performance because usually phone conversations are held with more qualified leads. Typically, the longer a conversation, the more successful a call—but considering that your occupancy is strong, calls could be shorter because there's not as much availability.

Calls that are too short, though, could indicate that a leasing agent is letting great leads slip through the cracks because they're not driving the leasing process.

Our clients have the ability to listen to phone conversations between prospects and leasing agents to perform their evaluations, and it's most likely that other property management companies also benefit from a similar call tracking technology.

If possible, listen to these conversations and get the answers to these following questions:

- Did your agent attain vital contact information?

- Did your agent engage and ask follow-up questions?

- Did your agent initiate and schedule an in-person showing?

- Did your agent create urgency?

The answers should be yes to each of these questions. If not, then you've identified areas where improvement is needed and you are then able to correlate that to your leasing staff.

The next metric to follow—lead-to-lease conversion rates—can help you better understand the types of leads your leasing agents are dealing with, and why they are, or aren't, closing at your preferred rate.

It's important to acknowledge that not all leads are created equal. If you're not satisfied with how many leads actually convert to leases, you may in fact want to start reconfiguring your marketing sources so that they're generating better qualified leads.

For example, an ILS does a great job of delivering a large amount of leads, but many of those leads aren't highly qualified. We see this play out in our own analysis, as a majority of leads generated from an ILS tend to email a leasing office rather than call. The problem with email leads is their conversion rates are very small, and they also slow down the entire leasing process. That isn't necessarily a leasing agent problem if they're stuck in the quagmire of dealing with many less qualified leads when they could be closing more often with better, more qualified leads who've called the leasing office instead. You can deliver more of these types of leads for your leasing staff by focusing on marketing sources that result in more phone call conversations rather than emails.

You can pursue further evaluation by also observing an in-person tour to see how agents interact with and sell to prospects, or even mystery shop your own apartment community.

The point is that, even when occupancy is stable, it's always beneficial to evaluate leasing teams and help guide them towards achieving sustained levels of success. That can be the difference in shortening any excessive days of vacancy that occur. You'll have also developed a team of leasing agents that you trust to be able to execute the lead-to-lease process, which will be really important when demand eventually changes.

Be Strategic With Lease Renewals

Even though your communities have higher occupancies, each will still experience unique seasonality. Demand typically ramps up in the spring before falling away in the winter. When a unit goes vacant during your busy leasing season, chances are you'll receive an application for it much quicker compared to if it had gone vacant during your slower leasing season.

That is why establishing a lease renewals strategy that positions more leases to expire during your seasons of high demand is another worthwhile pursuit for shortening the amount of vacant days between residents. Click here for tips to design a successful renewal strategy.

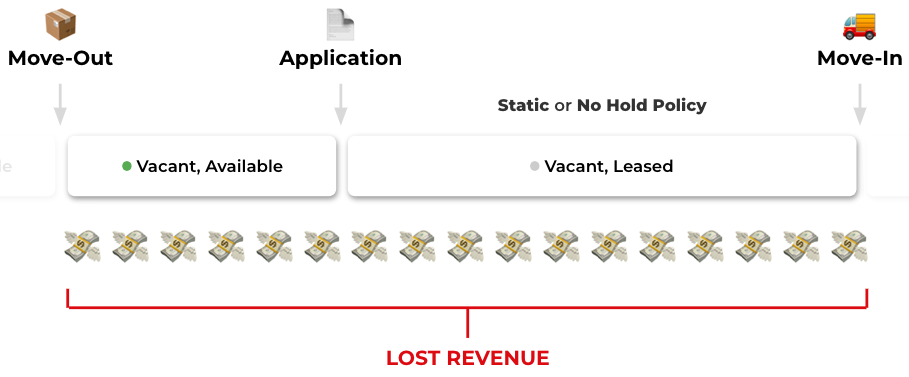

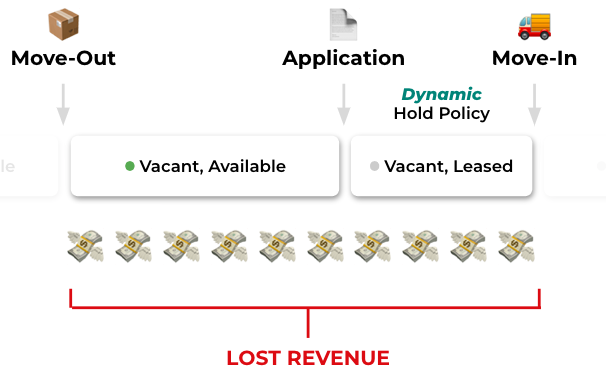

Adopt A Dynamic Hold Policy

Suppose the total number of days between residents is still higher than you'd prefer, even after making key adjustments within your marketing and leasing strategies. In that case, you need to look more closely at shortening the number of days after an application is received. More specifically, this means changing your apartment community's hold policy.

Most property management companies still apply a standard hold policy of 30 days (or another similar fixed number) at each of their communities and keep that policy static regardless of current performance. While it feels good to have a unit leased, holding it vacant for this long isn't sensible while you're also experiencing strong demand and occupancy as that will result in excess vacancy and lost rent.

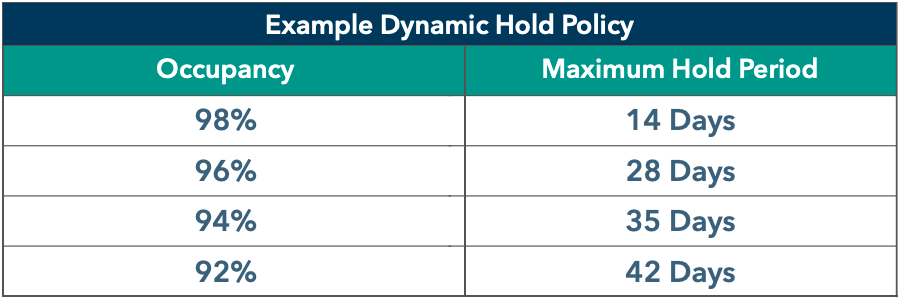

Consider cutting that timeline down when occupancy is strong so residents move in quicker. Then when you're in a vacancy crisis, you can lengthen this hold period because you want to avoid having any prospective resident willing to sign an application slip through the cracks. Adopting a dynamic policy like this that decreases (or increases) the amount of time you're willing to hold a unit based on performance will shorten the overall vacancy duration.

Here's an illustration of what a dynamic hold policy could be like at your apartment communities:

Option No. 3:

Raise Your Rent Prices

Earlier in this resource, we offered the following scenario to explain why it's wise to make your marketing spend more efficient when occupancy is strong:

To elaborate, if you have a 100-unit apartment community at 98% occupancy heading into the winter—typically the slowest time of year in our industry—you would feel safe in that position. Suppose, at that exact moment, 100 prospective residents are seeking to rent an apartment within your immediate marketplace. Why would you pay for all of your marketing sources and generate enough traffic and interest to fill 20 units when only two units are available?

If 20 prospects are eyeing your apartments when demand skyrockets, you can charge a higher amount in rent because you only need to convert 10% of all leads to sign a lease. That is why you should feel safe raising rents when occupancy is high, as that's a big win for your apartment community's bottom line.

To do this, you must be able to accurately assess your communities' current performance to know the exact timing of when and the right amount to raise your rent prices.

Revenue management software systems can help properties identify those two things very quickly. But can you trust those price recommendations? Most multifamily operators lack trust in legacy revenue management systems.

In transparency, RentVision is launching revenue management software. One difference with our software is that it only utilizes your community's supply and demand data to set the right price and automatically adjusts rental rates weekly in a way that property managers and prospective residents can easily understand—and, more importantly, trust.

Conclusion

Let's revisit the question asked in the introduction:

What if you could raise your revenue by 5%

while simultaneously decreasing your expenses by 1-2%?

That is possible at every single one of your stabilized apartment communities and should provide needed clarity for managers or marketers unsure of how to proceed when their occupancies are high.

We put forward three non-mutually exclusive options managers could choose from to optimize their revenue and maximize their highly-occupied communities:

The first was to make your marketing spending more efficient. When your supply is low, it's a great time to cut underperforming marketing sources (like an Internet Listing Service) because you don't need to pay for excessive traffic to your apartment community's website. It also means you can develop a dynamic and predictive marketing strategy. You can take control of your future vacancy by utilizing RentVision's predictive apartment marketing solutions.

The second option was to further increase occupancy by reducing the number of vacant days between residents at your apartment community. Investing in better marketing tactics, such as walkthrough video tours and floorplan-specific content on your community's website, will help minimize overall vacancy duration by enabling you to pre-lease currently occupied units. You can also evaluate your leasing staff to offer recommendations in areas where improvement may be needed. Finally, you can adopt a strategic approach to your lease renewals that ensures more leases expire during seasons when you're in high demand.

The last option was to raise rents—one that, quite honestly, should be an automatic decision when occupancy is strong. RentVision's revenue management software automatically raises rates with precision.

We hope the content featured in this resource enables you to take advantage of the opportunities to decrease expenses and maximize revenue at communities with high occupancy.

For more guidance and to learn more about RentVision, click this link to schedule a demo.